by: Sarah Hudacek, AOF Policy Associate

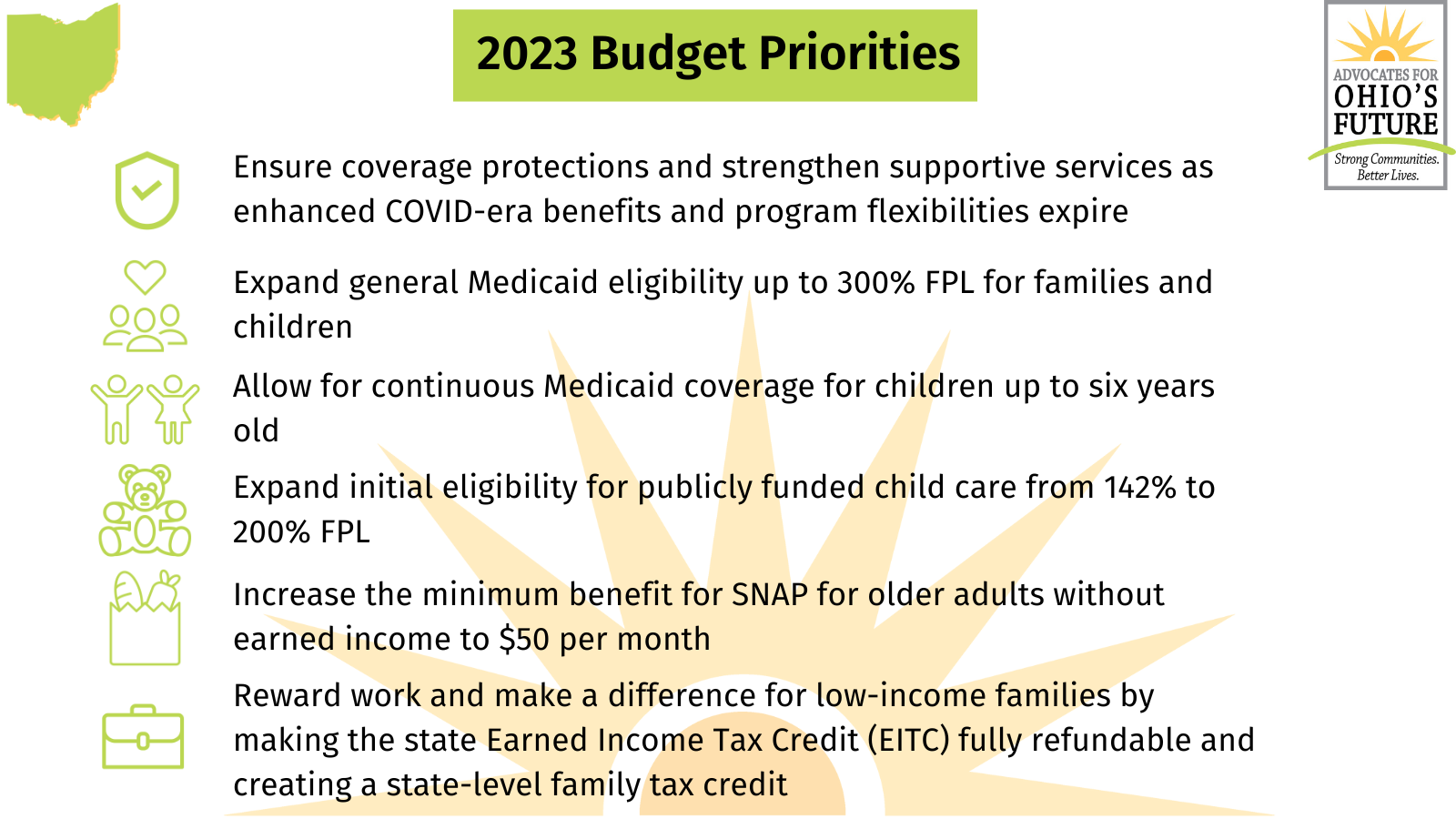

Budget priority: Reward work and make a difference for low-income families by making the state Earned Income Tax Credit (EITC) fully refundable and creating a state-level family tax credit

In 2021, the national child poverty rate fell to a record low of 5.2 percent, a drop of almost 30 percent. This decrease is largely attributed to the temporarily expanded federal Child Tax Credit (CTC), which benefited more than 2.1 million Ohio children across 1.2 million Ohio families. The CTC expansion ended in December 2021, and millions of children fell back into poverty. Although the Governor’s proposed state budget includes a $2,500 per child tax deduction, a deduction won’t result in a cash benefit for families each tax season. Instead, the child tax deduction would subtract $2,500 from a family’s taxable income and for a single mother of one making $40,000, would reduce her tax liability by only $69. The deduction would also not benefit the lowest income families who earn less than $26,050 in taxable income and therefore do not pay income taxes.

There are other, more substantial ways to reward work and support low-income families. Our partners at Policy Matters Ohio have developed two separate proposals for a state Thriving Families Tax Credit, which would provide a refundable credit to 1.8 million children across 985,000 households that make less than $85,000 per year. One proposal suggests a $700 annual tax credit per child, while the other proposes a $1,000 annual credit for children under 6 and a $500 annual credit for children age 6-17. AOF supports Policy Matters Ohio’s proposals to put more cash in families’ pockets and support Ohio children.

AOF has also long advocated for a refundable Earned Income Tax Credit (EITC). With Ohio’s nonrefundable EITC, the credit amount can only be applied towards a low-income Ohio worker’s outstanding tax liability, but doesn’t result in an increased cash return. A refundable EITC would allow low-income Ohio workers to receive a cash refund for the amount of the credit not applied towards any outstanding tax liability. The federal EITC is refundable.

Ohio adopted a state EITC in 2013 and increased the value of the credit in 2019. Thirty-one states have a state EITC, but only six states, including Ohio, have a nonrefundable credit. A bill pending in the Ohio legislature would make the state EITC refundable at 10 percent of the federal EITC amount. This partially refundable EITC would take an important first step towards rewarding work and supporting low-income Ohioans, but would still leave Ohio with one of the weakest EITC programs in the nation.