Kelsey Bergfeld

Director, Advocates for Ohio’s Future

Susan Jagers

Public Policy Chair, Advocates for Ohio’s Future

Director, Ohio Poverty Law Center

Will Petrik

Executive Committee Member, Advocates for Ohio’s Future

Project Director, Policy Matters Ohio

Nick Bates

Co-Chair, Advocates for Ohio’s Future

Director, Hunger Network in Ohio

Chairwoman Carruthers, Ranking Member Liston, and members of the House Finance Health and Human Services Subcommittee, my name is Kelsey Bergfeld and I am the Director of Advocates for Ohio’s Future. Advocates for Ohio’s Future (AOF) is a nonprofit, nonpartisan coalition of over 500 state and local health and human services policy, advocacy and provider organizations that strive to strengthen families and communities through public funding for health, human services, and early care & education. We work to empower and support nonprofit organizations and the health and human services workforce in the critical work they do, especially as it relates to lifting up and caring for all Ohioans. I am joined today by a number of my Executive Committee leaders. A full list of AOF Steering Committee members is included at the end of our testimony and also available at www.advocatesforohio.org.

As a coalition of a broad range of health and human service organizations, we unite to identify and prioritize the greatest needs of people and families across the state. We couldn’t agree more with Governor DeWine’s goal of making Ohio the best state to live, work and raise a family. The proposed budget bill before you today includes policies and investments that will help move Ohio towards that goal. In addition to the provisions to be covered by my accompanying members we are encouraged to see:

a proposed $4 million per year increase to the adult protective services line item

increased funding for the Help Me Grow Program

and increased funding for children’s services agencies.

Though we’d like to think the challenges of the public health and economic crises are far behind us, the impacts are still being felt across our state. Today, hundreds of thousands of children, adults, and families struggle to afford food, rent, utilities, and other basic necessities. Currently, Ohio’s hunger relief network provides take-home groceries, meals, and personal care items to 1 million Ohioans each month, 1 in 4 Ohio renter households spend more than half their income on rent and utilities, and nearly 17 percent of Ohio’s children live in poverty. Growing up hungry or in an unstable family situation have been identified as adverse childhood experiences, or ACEs, by the CDC and Kaiser Permanente that can have lasting, negative effects on health, well-being, as well as life opportunities such as education and job potential.

AOF is also concerned that thousands of Ohioans who are already struggling to make ends meet will lose resources to keep food on the table and lose healthcare coverage as COVID era flexibilities and enhanced supports unwind. We are thankful for past investments made by the previous general assembly to help support basic needs like food and housing, while also supporting our county jobs and family services agencies who connect people to the help and supports they need to get back on their feet.

This is why we support public programs that provide economic security, help people get to work, support a strong recovery, and empower Ohio residents.

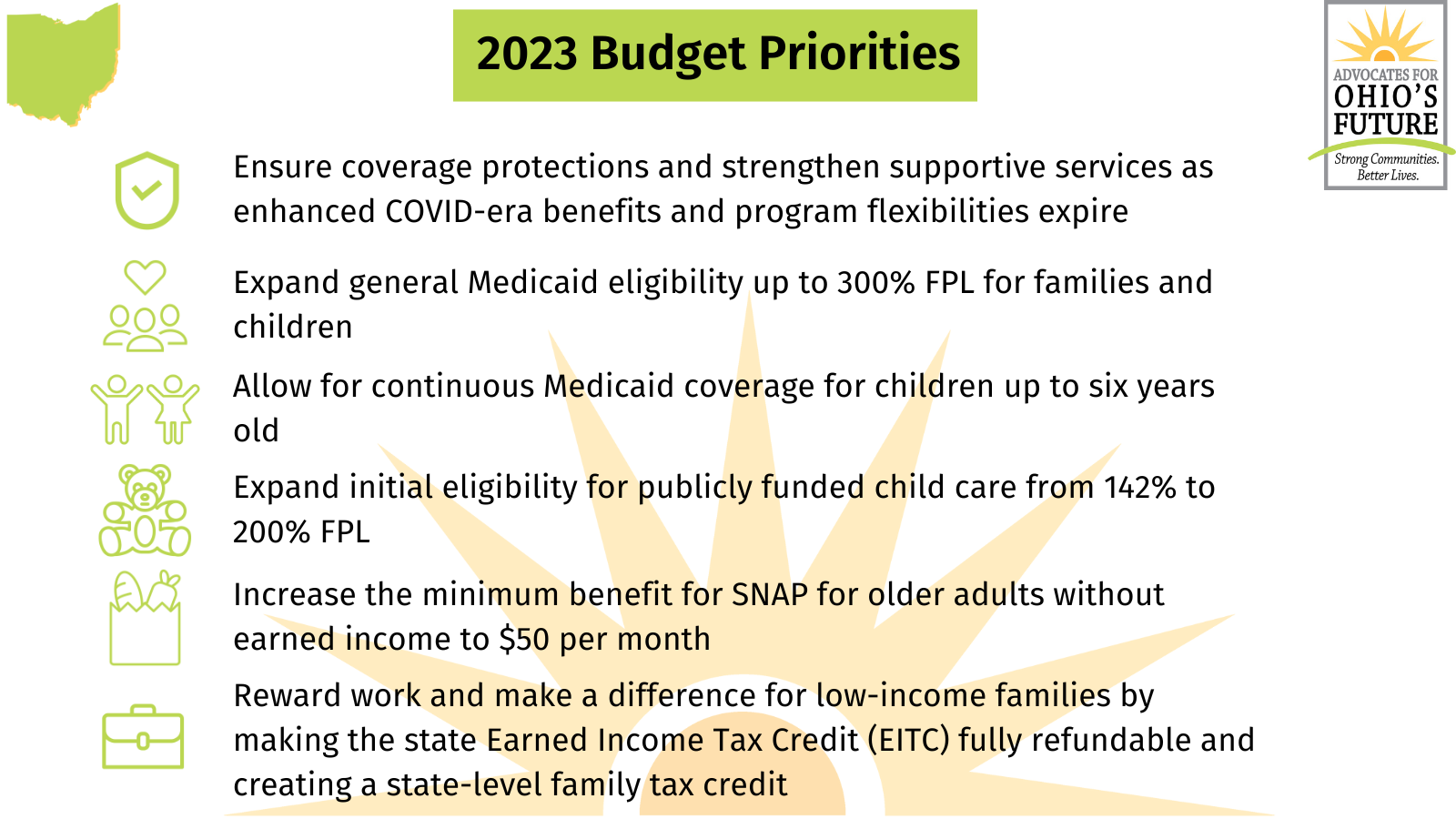

Among the proposals that AOF supports adding to this year’s budget are:

$50 million per year to help the Ohio Association of Foodbanks meet the increased need at food banks and pantries across the state. With the end of SNAP emergency allotments last month, all SNAP recipients saw an immediate loss of at least $90 per person, per month in fully federally-funded food assistance benefits. Ohio’s network of foodbanks cannot support the increased demand following this loss without additional investment.

$2.5 million per year for in-person health insurance enrollment assisters, who will continue to provide free help to Ohioans navigating the Medicaid eligibility renewal process over the next 15 months of unwinding and to assist in connecting former Medicaid members to the federal Marketplace for health coverage.

$21 million per year to provide a $50 per month state-supplemented minimum SNAP benefit to all Ohioans age 60 and up. With the end of SNAP Emergency Allotments, older adult households will see a loss of $250 per month in federally funded assistance, or more. Approximately 70,000 of these older adults will return to the SNAP minimum benefit of just $23 per month. A state SNAP supplement would go a long way to ensure Ohio’s older adults don’t have to solely rely on the charitable food network to eat.

Up to $350 million per year to provide free school breakfast and lunch to all students in Ohio. During the height of the pandemic, school meals were free for all students. Since the end of this temporary pandemic program, school meal debts have accumulated to record numbers in many school districts and school meal participation is down across the board. When a student reaches a certain level of debt, a hot meal is taken away from the student in the lunch line and a brown-bag lunch is provided. Students can’t learn when they’re hungry, which is why AOF supports free, healthy school meals for all.

The creation of a dedicated SNAP Employment & Training line-item and an investment of $10 million per year to support county Job and Family Services offices in helping unemployed and under-employed SNAP recipients find and retain employment. This investment will draw down a federal 50/50 match.

The restoration of the Employment Incentive Program for Critical Jobs line item at $5 million per year in flexible funding to counties to help address the benefit cliff and fill gaps between programs, such as helping with health insurance costs if an individual is no longer eligible for Medicaid, or assisting with informal child care arrangements before or after school.

Any discussion of supporting the health and recovery of Ohioans cannot be complete without addressing the direct care workforce crisis faced by every sector of the home and community-based services spectrum. Different rates and requirements for similar work result in competition for a small number of workers and an imbalance in the system. Although we were encouraged to see an increase in the hourly wage for direct care workers up to $16 per hour in the Governor’s proposed budget, AOF supports our member organizations, disabled Ohioans, and older adults in respectfully requesting an increase up to a minimum wage of $20 per hour for all direct care workers across the Departments of Aging, Medicaid, and Developmental Disabilities. Direct care work has been undervalued and under compensated for so long that our care systems are hitting a breaking point. Unless Ohio recognizes and rewards direct care workers for the valuable work they provide in communities across Ohio, our care systems will continue to see high turnover, high vacancy rates, long wait lists, and more agency closures.

In addition to increasing wages, AOF supports investments in programs that remove barriers to work for critical occupations such as direct care, including the new program to establish a child care scholarship for direct care workers that will be further discussed by our panelists.

Equity should be an explicit consideration in constructing the budget. Laws and policies have institutionalized racism and bias against marginalized groups. Ohio should allocate resources and services to at-risk populations to ensure an individual’s well-being and success are not predictable by race, class, geography, language, gender, or other relevant social factors. Governor Mike DeWine formed the COVID-19 Minority Health Strike Force on April 20, 2020, in response to the disproportionate impact of COVID-19 on minorities in Ohio. The strike force contracted with the Health Policy Institute of Ohio (HPIO) to develop the “COVID-19 Ohio Minority Health Strike Force Blueprint” which contains actionable recommendations to improve health outcomes and overall well-being for communities of color in Ohio. We recommend that this committee and the full general assembly consider these recommendations and commit to promoting equity and better health outcomes for all Ohioans.

This budget is an opportunity to invest in improving the quality of life of all Ohioans. AOF and our partner organizations support policies that build an Ohio where all people and families live healthy lives in quality communities with pathways to prosperity for all.

Susan Jagers, AOF Public Policy Chair and Director of the Ohio Poverty Law Center

Chair Carruthers, Ranking Member Liston, and Members of the House Finance Health and Human Services Subcommittee, thank you for the opportunity to provide comments on the portions of the budget that address Medicaid and lead poisoning prevention, treatment, and mitigation.

My name is Susan Jagers and I am the director of the Ohio Poverty Law Center. Our mission is to reduce poverty and increase justice by expanding the legal rights of Ohioans living, working, and raising their families in poverty. We work with Ohio’s network of legal aid offices that provide free legal services to low-income Ohioans. I also serve as chair of Advocates for Ohio’s Future’s policy committee.

Medicaid

Ohio’s Medicaid program delivers healthcare access and related community support services to more than 3.4 million Ohioans, including children, pregnant women, adults, seniors, and individuals with disabilities, across the life spectrum. The following statistics highlight this significant role in serving Ohioans:

More than 1.3 million children are served by Medicaid.

Over half of Ohio births are covered by Medicaid.

More than 16,500 children are enrolled and receiving specialized services through OhioRISE.

We appreciate your investments in the last budget to expand coverage to new mothers for 12 months postpartum and to fund initiatives including OhioRISE which seek to improve care and prevent custody relinquishments for children with complex health care needs.

Advocates for Ohio’s Future is pleased to support several initiatives included in House Bill 33 including:

Proposed rate increases for Medicaid providers to address health care provider shortages. Many of our member organizations have provided testimony and information about workforce shortages and the need for rate increases.

Expanding Medicaid coverage to include pregnant women and children up to 300% of the federal poverty level and privately adopted children. This change will cover an additional 30,000 children and an estimated 3,500 pregnant women.

Completing the full implementation of the Next Generation of Managed Care Program, which includes the continuation of the OhioRISE Program. The Next Generation of Managed Care Program comes with requirements for improved care coordination, streamlined grievances and appeals, and significant investments in social determinants of health.

We do ask that you consider complementing Governor DeWine’s proposal to improve eligibility and coverage for children by adding two provisions to the budget:

Extend continuous coverage for children up to age six. With continuous coverage, once young children are eligible for Medicaid, their parents would not have to worry about re-enrolling them until they start elementary school making it more likely that these young children will get their regular doctor visits, health screenings and developmental checks.

Provide Medicaid reimbursement for doula services to strengthen maternal and infant health outcomes. This body supported coverage for doula services when you passed House Bill 142 last year with near unanimous support.

Lead Poisoning Prevention, Treatment, and Mitigation

Lead is a toxin, and there is no safe level of lead in the blood. Childhood lead poisoning can cause irreversible brain and nervous system damage leading to learning and behavioral challenges, lower academic achievement, and other poor outcomes. Ohio has the second highest rate of children testing positive for elevated blood levels in the country.

The number one source of child lead poisoning is lead dust from old lead paint in houses built before 1978.

In last session’s House Bill 45, you invested American Rescue Plan dollars for lead abatement, including funding for lead poisoning prevention projects and workforce development for lead contractors—these programs are administered by the Ohio Department of Development.

This investment is a critical boost to Ohio’s lead mitigation efforts. Thank you.

House Bill 33 contains several critical investments in primary prevention and treatment, and we ask you to support these investments:

$10.8 million in FY24 and $11.7 million in FY25 for the lead abatement fund at the Ohio Department of Health and budget language to support lead prevention programs that provide grants to local communities, ensure lead safe work protocols during renovations and repairs, and provide education and resources for parents. We ask you to support his funding.

Funding for Early Intervention for Lead Poisoned Children for supportive, home-based services for children under three years old who test for elevated blood lead levels at $23.4 million each fiscal year. We ask you to support this funding.

H2Ohio funding to OEPA for Clean Water to replace lead service lines and support water affordability measures is funded at $31.3 million in each fiscal year. We ask you to support this funding.

The State Children’s Health Insurance Program (SCHIP) Lead Program for High-Risk Children removes lead hazards in homes built before 1978 with children under 6 years of age or pregnant women. We ask that you increase the current Ohio Department of Medicaid spending authority from $5 million to $10 million per fiscal year.

Finally, we ask that you create a position within the new proposed Department of Children & Youth to focus on lead issues and streamline coordination and communication between the various agencies and committees working on lead poisoning prevention. This will ensure continuity and collaboration to maximize the impact of public funds dedicated to lead prevention.

Investments in these prevention programs will reap financial and other benefits for the state of Ohio and most importantly will keep kids safe and healthy.

Will Petrik, AOF Executive Committee Member and Project Director with Policy Matters Ohio

Chairwoman Carruthers, Ranking Member Liston and members of the Subcommittee, my name is Will Petrik. I am the Project Director with Policy Matters Ohio, a nonprofit, nonpartisan organization. Our mission is to create a more prosperous, equitable, sustainable and inclusive Ohio. Thank you for the opportunity to testify today on House Bill 33.

In my testimony, I will highlight priorities we support in Gov. DeWine’s proposed budget and share ways we can work together to ensure that all Ohioans, no matter where we live or what we look like, have stability, economic security and basic human dignity.

Budget priorities that support the well-being of children and families

The proposed budget will prepare more of our youngest children to be ready to start kindergarten and help parents stay in the workforce. It will help an estimated 15,000 children get the care they need by expanding eligibility for publicly funded child care to more working parents.[1] Gov. DeWine’s budget also proposes a significant new investment in public preschool, which would mean an additional 11,525 3- and 4-year-old children in families with low incomes will have an opportunity to get high-quality early childhood education.[2] High-quality early care and education gives children a strong start and improves their long-term health and economic opportunities.[3]

H.B. 33 appropriates $150 million in SFY 2024 from one-time American Rescue Plan Act (ARPA) funding to help ensure that child care professionals and professionals in other critical occupations can afford child care for their own children. It will establish a child care scholarship program for critical occupations and direct-service professionals who make up to 200% of the federal poverty level ($49,720 for a family of three), expanding access to child care, including infant and toddler care.[4]

We support these investments, and we must do more to make sure more Ohioans have the resources to pursue their dreams.

More than 460,000 Ohio children lived in poverty in 2021.[5] Four of the 10 most common jobs in our state don’t pay enough to feed a family of three without food assistance.[6] Ongoing inflation is making it harder for parents to afford groceries, child care, and heat for their homes.

Compared to their more economically secure peers, children who are hungry or who grow up in poverty are more likely to do worse in school, have health problems or behavioral issues, and get involved with the criminal legal system as adults.[7] On the other hand, when kids have economic stability and enough to eat, they are healthier and do better at school.[8]

As my colleagues have highlighted, things are about to get worse for many of our neighbors. An estimated 673,000 households in Ohio will have fewer resources to keep food on the table and 220,000 Ohioans are at risk of losing health coverage.[9] We must expand opportunity for these Ohioans and make sure our neighbors can live with stability and economic security.

Increase family stability and security: Change the tax code to support families

The proposed child tax deduction in H.B. 33 won’t support the families who need it most. Under the proposal, a family with two kids making $200,000 a year would save nearly $200 each year. A family with two kids making $29,000 won’t get a dime from the deduction.[10]

Policy Matters Ohio recently released a report that outlines a new solution: the Thriving Families Tax Credit. This proposal would support nearly a million families making less than $85,000 and benefit an estimated 1.8 million children with an average annual tax refund of roughly $1,000 per family. A state thriving families tax credit would help families pay for the basics. We estimate that 77% of Black children in Ohio would benefit and an estimated 300,000 families in the 32 Appalachian counties would be eligible for the credit.[11]

A 10% refundable Earned Income Tax Credit would also put more money in the pockets of Ohioans who work hard every day. Ohioans who are paid low wages would have additional resources to help with food, safe housing, health care and other basic family expenses. According to a 2020 analysis from the Institute on Taxation and Economic Policy, adding a 10% refundable state EITC would help an estimated 748,000 families in Ohio. It would provide an annual average payment of $324 to families earning between $22,000 and $40,000 a year.[12]

Instead of more tax giveaways to the wealthiest Ohioans, we encourage lawmakers to change the tax code to make sure all Ohioans can live with security and thrive.

Expand opportunity: Help more parents participate in the workforce

State lawmakers can ensure all Ohioans are able to support their families and participate in the economy. The proposed budget takes a step to make child care more affordable for some working families, child care professionals and Ohioans in critical occupations. We encourage you and your colleagues to take a larger step and make child care affordable for all who need it. Under the proposed budget, a single mother with a 2-year-old and a 4-year-old earning $40,000 annually would spend roughly 44% of her income on child care, but she makes too much to qualify for public support. She’d have little left over for housing, groceries, healthcare, and other basic necessities.

State lawmakers can change that by boosting initial eligibility for publicly funded child care up to 200% of the federal poverty level. At that level, a family of four could make up to $55,500 and be eligible for public support to help pay for child care. Expanding access to child care will help more parents participate in the workforce, and better prepare our children for the future. When families and communities thrive, we all benefit from a stronger economy and a more prosperous state.

Thank you for your commitment to building an Ohio where all of us can live with dignity and security. Together, we can ensure all Ohioans can thrive. I welcome any questions or concerns you have about the content of my testimony.

Nick Bates, AOF Co-Chair and Director of the Hunger Network in Ohio

Thank you, Chairwoman Carruthers and Ranking Member Liston for the opportunity to testify today as part of this very insightful panel.

My name is Nick Bates. I am a Deacon in the Evangelical Lutheran Church in America (ELCA) and serve as the director of the Hunger Network in Ohio. I currently also serve as co-chair of Advocates for Ohio’s Future. I would like to thank my colleagues today for their ongoing research, scholarship, and expertise on how we can improve lives and strengthen communities. As we enter the final weeks of sub-committee hearings, I want to ask you three questions to guide your deliberations in shaping Ohio’s next two-year operating budget.

The first is if this Budget will be a roadmap toward strengthening communities?

The old adage says that an ounce of prevention is worth a pound of cure. When we invest now to reduce poverty, hunger, and long-term health consequences we will save money down the road. For example, 50% of children who experience hunger will need to repeat a grade.[13] Investments to reduce hunger, expand housing, and lift Ohio families out of the constant crisis of poverty will save Ohio money in the long run and strengthen our communities.

My second question - does this budget improve the lives of our neighbors?

In our faith communities and social ministry organizations, families don’t ask for assistance after the first or second crisis. Many families don’t ask for the help they need until the towering pile of crisis moments topples over and begins to suffocate them. 29% of Ohio families live at or below 200% of the federal poverty level.[14] These families are working hard to climb out from the pile of crisis moments each day. We have the opportunity to provide the structural supports needed to help families move toward stability.

My final question - does this budget meet our moral commitment to our future?

The budget process is filled with line items and legal language, but I encourage you to step back for a moment. Take a step back from LSC notes, analysis, and economic forecasts. Ask yourself what type of community do you want to build up? What type of community do you want Ohio to be and does this budget move us in that direction?

We can build a state where our children will have better schools and food security. Where our seniors are cared for and loved. We can build a community where those who are suffering with mental and physical health conditions can receive the care they need. This budget can invest into an Ohio where those who are called the least of these receive their daily bread.[15] None of us know what tomorrow holds. We encourage you to invest in services, structures and supports that guarantees Ohioans, basic dignity, stability, and support. Thank you.