Today, Advocates for Ohio’s Future submitted our comments and sign-on letter in response to Ohio’s proposed Medicaid work requirements waiver, which was released for public comment on December 17, 2024. The letter was signed by 49 organizations and 93 individuals across 24 counties who share AOF’s concerns.

Announcing AOF's 2025 Steering Committee!

Advocates for Ohio’s Future is proud to announce our 2025 Steering Committee and leadership. Each of these 28 organizations and advocates bring a unique and important voice to AOF and give countless hours to the leadership and governance of AOF.

Returning for her second year as Co-Chair is Susan Jagers, Director of the Ohio Poverty Law Center. Joining Susan is newly elected Co-Chair Charlotte Rudolph, Executive Director of the Universal Health Care Action Network of Ohio.

It is AOF’s honor and privilege to be in coalition with these 28 incredible organizations and the work they do. Thank you to our members for their leadership and support!

AOF Co-Chairs

Susan Jagers, Ohio Poverty Law Center

Charlotte Rudolph, Universal Health Care Action Network of Ohio

AOF Executive Committee

Teresa Lampl, AOF Communications Committee Chair, The Ohio Council of Behavioral Health & Family Services Providers

Darold Johnson, AOF Public Policy Committee Chair, Ohio Federation of Teachers

Joree Novotny, AOF Finance & Development Committee Chair, Ohio Association of Foodbanks

Nick Bates, AOF Outreach Committee Chair, Hunger Network in Ohio

Tara Britton, The Center for Community Solutions

Steering Committee

Randy Leite, Appalachian Children Coalition

John Stanford, PhD, Children’s Defense Fund-Ohio

Scott Neely, Children’s Hunger Alliance

Megan Riddlebarger, Corporation for Ohio Appalachian Development

Lynanne Gutierrez, Groundwork Ohio

Michael Corey, Human Service Chamber of Franklin County

Rose Frech, Integrated Services for Behavioral Health

Laura Padgett, Mental Health & Addiction Advocacy Coalition

Beth Kowalczyk, Ohio Association of Area Agencies on Aging

Kelly Carey, Ohio Association of Community Health Centers

Prince Ohilebo Garuba, Ohio Association of Goodwill Industries

Kate Rossman, Ohio Children’s Alliance

Amy Roehrenbeck, Ohio Child Support Professionals Association

Veronica Brady, Ohio Family & Children First Coordinators Association

Laura Abu-Absi, Ohio Job and Family Services Directors’ Association

Teresa Kobelt, Ohio Provider Resource Association

Jeremy Morris, Ohio Statewide Independent Living Council

Rebecca Kusner, Ohio Workforce Coalition

Kathryn Poe, Policy Matters Ohio

Scott Britton, Public Children Services Association of Ohio

Ohio Nonprofit Coalitions Urge U.S. Senate to Reject Bill Threatening Nonprofits

On Thursday, November 21st, the U.S. House of Representatives passed legislation that would allow the Secretary of the U.S. Treasury to unilaterally rescind the 501c3 status of nonprofit organizations that the Secretary deems to be “terrorist supporting organizations.”

Advocates for Ohio’s Future joins with The Center for Community Solutions and the Human Service Chamber of Franklin County in urging the U.S. Senate to reject this legislation. See our joint statement below and at this link.

For Immediate Release: Senate Bill 240 Will Harm Low-Income Ohioans

For Immediate Release: Wednesday, June 26, 2024

Senate Bill 240 Will Harm Low-Income Ohioans

Advocates for Ohio’s Future responds to proponent testimony this morning

(Columbus) This morning, an out-of-state lobbyist, who lives in Virginia and works for a Florida-based conservative think tank and its 501(c)(4) arm, was the sole proponent of Senate Bill 240 (Senator Tim Schaffer, R-Lancaster), a bill that would make it harder for families across Ohio to access food and medical assistance.

The provisions in SB240 are recycled from previous conversations in the General Assembly, including from House Bill 200 from the 133rd General Assembly, Senate Bill 17 and House Bill 651 from the 134th General Assembly, Senate Substitute House Bill 110 from the 134th General Assembly, Senate Substitute House Bill 33 in the 135th General Assembly, and the Public Assistance Benefits Accountability Task Force, to name just a few.

Time and time again, Ohio advocates have rejected these cookie-cutter ideas that are introduced in states across the nation because we know that these tired ideas are rooted in a fundamental misunderstanding of the challenges faced by low-income families and will simply not work for Ohio – and would cause harm if implemented.

"Health and human service providers, staff, and volunteers work hard everyday to serve our neighbors in need. The last thing struggling Ohioans need is out-of-state interest groups taking a sledgehammer to our public benefits systems," said Deacon Nick Bates, Director of the Hunger Network in Ohio and Co-Chair of Advocates for Ohio’s Future (AOF).

AOF stands in firm opposition to the creation of any additional barriers and bureaucratic red tape that would prevent Ohioans from seeking and receiving help in times of financial crisis. AOF, our members, and our partners stand ready to provide solutions to the very real challenges faced by low-income Ohioans on the verge of crisis, none of which are addressed in SB240.

###

Advocates for Ohio’s Future is a nonprofit, nonpartisan coalition of health and human services policy, advocacy and provider organizations seeking to protect Ohio’s most vulnerable citizens through a responsible state budget that adequately funds vital services.

Contact:

Sarah Hudacek, 567-207-5565

shudacek@communitysolutions.com

Advocates for Ohio’s Future Announces New Coalition Manager

After nearly a year as Interim Director, Sarah Hudacek will lead Ohio advocacy organization

COLUMBUS, April 25, 2024—Sarah Hudacek has been appointed Coalition Manager of Advocates for Ohio’s Future, after three years with the organization. With 30 member organizations and 500 endorsers, AOF supports policies that build community prosperity for all Ohioans, developing comprehensive strategies to address benefit cliffs and strengthen supports across programs.

"We are excited to have Sarah on as AOF's coalition manager. Her attention to detail and compassion for all Ohioans is a gift to health and human service advocates, providers, and the communities we serve," said Nick Bates, Director of Hunger Network in Ohio and AOF Co-Chair.

AOF works with partners and members across the state on projects like State Budget trainings and creating legislative toolkits for advocacy efforts. Partnering with Ohio Poverty Law Center, AOF maintains the OhioARPATracker.org and related advocacy to ensure Ohio’s American Rescue Plan Act funds are fully utilized. AOF provides free weekly newsletters, nonpartisan voting resources, public program infographics, blogs, webinars, and more.

“Sarah works every day to ensure that AOF is a trusted resource for policymakers, partners, and community members. We are lucky to have her leading our collective work,” said AOF Co-Chair Susan Jagers, Director of Ohio Poverty Law Center.

Sarah brings policy experience from her internships in Washington, D.C. at the White House and the U.S. Department of Health and Human Services. She graduated from The Ohio State University with a bachelor’s degree in Public Management, Leadership and Policy.

##

Advocates for Ohio’s Future (AOF) is a nonprofit, nonpartisan coalition of state and local health and human services policy, advocacy and provider organizations that strive to strengthen families and communities through public funding for health, human services, and early care & education. We work to empower and support nonprofit organizations and the health and human service workforce in the critical work they do, especially as it relates to lifting up and caring for all Ohioans.

The 2024 State of the State

by: Sarah Hudacek, Coalition Manager

This week, Governor DeWine delivered his annual State of the State address, which, in a historic move, focused almost entirely on Ohio youth from birth through higher education. Many of the proposals the Governor introduced are promising steps towards making Ohio the best state to live and grow up. Ohio adults and older adults are vital parts of a healthy Ohio, as well. AOF continues to advocate for policies and investments that make Ohio not just the best state to live and grow up, but to later work, raise a family, retire, and age.

Here’s a run-down of the parts of Governor DeWine’s speech we’re watching most closely:

Child Care

Governor DeWine announced a new Childcare Choice Voucher Program that would serve families up to 200% of the federal poverty level and would cap co-pays at 9% of a family’s income. Publicly Funded Child Care initial eligibility in Ohio is currently limited to 145% FPL. The Voucher program would use American Rescue Plan dollars to temporarily expand child care support to more families through June 2025.

DeWine also announced $85 million in ARPA funding for Childcare Access Grants to improve and expand child care facilities. This competitive grant is open for applications now through April 26th and is intended to support programs with costs to either increase capacity through new or existing programs, complete repairs, or provide additional support to staff and families.

Child Well-Being

DeWine announced the creation of the Children’s Vision Strike Force to scale existing local models for comprehensive eye exams for children statewide.

DeWine touted successes in School-Based Health Clinics and urged school districts across the state to utilize existing resources to build additional school-based clinics, with the help of the Ohio Department of Education and Workforce and the Ohio Department of Health.

Maternal and Child Health

DeWine announced a new pilot program in 11 Ohio counties called Family Connects, which will make every new mother eligible to receive a nurse visit around 3 weeks postpartum. The Governor’s goal is to expand this program statewide next year.

Health and Safety

DeWine re-affirmed his desire for a ban on flavored cigarette and vaping products, this time through a statewide ban, rather than previous unsuccessful legislation to allow localities to implement bans on their own.

DeWine supported the initial recommendations of the Juvenile Justice Working Group, saying he will ask for funding in the future to place youth within the juvenile justice system in smaller facilities.

Read Governor DeWine’s full speech HERE.

Full State of the State Video | Speaker Stephens Response | Democrat Joint Response

Summer Food Service Program & Summer-EBT

by: Andy Jesson, AOF Policy & Communications Intern

One in seven children face hunger in Ohio. The nearly 400,000 Ohio youth who may not know where their next meal is coming from rely on public programs and charitable contributions to obtain the necessary food to thrive. Once again this summer, all Ohio children are eligible for participation in the Ohio Summer Food Service Program, Ohio’s edition of the federal Summer Food Service Program, while qualifying families may also be enrolled in the newly-created Summer-EBT program.

The Summer Food Service Program (SFSP) is a federally funded, state-run program designed to bridge the gap for children facing food insecurity during summer months when school in not in session. Data from the 2021-2022 academic year showed 57 percent of Ohio’s school-aged children, or about 912,000 students, were eligible for and participated in free and reduced-price lunch programs. Free and reduced lunch programs at school ensure children receive at least one nutritious meal each day, at little or no cost.

Despite the success of free and reduced lunch programs on mitigating food insecurity for children across the United States and offsetting costs for low-income parents, an obvious gap remains for students during the summer months, when school is not in session and students do not receive free/reduced price meals. SFSP in Ohio is available to all children ages 1 through 18, and does not require registration. In 2023, Ohio’s summer program sponsors operated more than 2,000 sites across the state, serving more than 5 million meals to Ohio children.

This year, Ohio’s SFSP is focused on expanding reach to rural communities across the state. To open a site, eligibility must be determined using school data, census data, or census block grouping. Using data prior to opening a site is intended to ensure the program is accessible to students who are in the greatest need for food assistance.

In addition to providing meals and snacks to Ohio children, the SFSP also serves as an opportunity for students to continue learning while school is not in session. Some sites offer summer activities or learning programs for children. Due to the nature of the program, sponsors operating sites throughout the state are eligible to be reimbursed for costs.

The USDA website includes a Summer Meals for Kids Site Finder, a tool parents can use to find directions, operating hours, and contact information for meal sites. The finder is set to go live in early May.

Apart from SFSP, in a new federal initiative, this summer marks the start of Summer-EBT for low-income Ohioans. Ohio families who meet income requirements will receive $40/month per child to help offset the loss of school meals during the summer months. The $40 monthly payments will come in the form of a $120 lump-sum loaded to an existing SNAP card or new EBT card mailed to households in the child’s name.

Ohio children whose families completed a free or reduced-price meal application during this academic year will automatically be enrolled in Summer-EBT, as will families already enrolled in SNAP, Medicaid, or TANF. Children who may be eligible but are not yet automatically enrolled include those who are eligible for free or reduced-price lunch but have not completed an application. An application for Summer-EBT is expected to open around April 15. Nationally, it is estimated that the USDA will provide $2.5 billion in grocery benefits through the Summer-EBT program.

The Summer-EBT program represents a continuation of benefits families received during the COVID-19 pandemic through Pandemic-EBT. Research on Pandemic-EBT showed it to have far-reaching effects on child hunger, including a 33 percent reduction in food hardship, and between 2.7 to 3.9 million children lifted out of hunger. This summer and beyond, the Summer-EBT program holds the potential to significantly reduce the burden of hunger of Ohio’s children and their families.

Legislation We're Watching

by: Andy Jesson, AOF Policy & Communications Intern

As part of our effort to improve the health and human services landscape for all Ohioans, AOF is always tracking state legislative efforts related to our work. Below is an overview of some of the major pieces of legislation AOF is tracking, including links to bills, information about co-sponsors and movement, as well as descriptions regarding what each bill seeks to implement.

Direct state funds for economic growth and community development (Capital Funds)

Sponsors: Representatives Al Cutrona and Terrence Upchurch

HB 2 was passed by the House on February 7, 2024, and introduced in the Senate on February 13. The legislation would give $1.65 billion in state capital spending and appropriate another $350 million from the One-Time Strategic Community Investment Fund towards projects across Ohio.

Enact the Strong Foundations Act

Sponsors: Representatives Andrea White and Latyna Humphrey

HB 7 was introduced in the House on February 15, 2023, and reported to the Rules and Reference Committee on June 13, 2023, where it awaits further movement. HB 7 requires the Ohio Board of Nursing to establish a registry of certified doulas, while also establishing the Doula Advisory Board within the Board of Nursing. HB 7 also requires the Department of Medicaid cover doula services provided by a certified doula with a Medicaid provider agreement. The legislation covers a wide range of issues, including efforts to establish an informational pregnancy and postpartum mobile app, appropriations for maternal-focused housing initiatives, revisions and appropriations to Help Me Grow, continuous Medicaid enrollment for young children, early childhood mental health services, and more.

Regards single-sex bathroom access in schools, universities

Sponsors: Representatives Beth Lear and Adam Bird

HB 183 requires public and chartered nonpublic schools, educational service centers (ESCs), and institutions of higher education to designate specified facilities for the exclusive use of students either assigned female at birth or assigned male at birth. The legislation was introduced in the House on May 23, 2023, and referred to the Higher Education Committee on June 7, 2023. During the fourth hearing on January 10, 2024, primary sponsor of the bill, Representative Adam Bird announced a slight change in the language of the bill.

Modify procedures to conduct property tax sales-assessment study

Sponsors: Representatives Thomas Hall and Adam Bird

Passed by the House on October 11, 2023, and passed by the Senate on December 6, 2023, HB 187 temporarily increases the amount of all property tax homestead exemptions and expands eligibility for seniors and Ohioans with disabilities. Following passage by the House, the Ohio Senate unanimously passed an altered version of the legislation. The House has not yet voted on/agreed to the changes adopted by the Senate.

Authorizes certain public bodies to meet virtually.

Sponsors: Representatives James Hoops and Thaddeus Claggett

Passed with overwhelming bipartisan support on November 29, 2023, HB 257 currently awaits movement in the Senate Government Oversight Committee. HB 257 allows public meetings to be held virtually once the public body has adopted certain policies, including means for the public to view virtual meetings. Public meetings can be held virtually only if all parties participating in the hearing consent, and meetings may not be virtual if it involves voting on a major nonroutine expenditure, significant hiring decision, or a vote on a tax issue or tax increase.

Authorizes a property tax freeze for certain owner-occupied homes

Sponsors: Representatives Dani Isaacsohn and Thomas Hall

HB 263 was introduced in September 2023 and referred to the Ways and Means Committee, where multiple hearings have been held. If passed, the legislation would freeze property tax amounts for older Ohioans who own homes, ensuring individuals often on a fixed income do not pay a larger property tax bill year-over-year. On February 6, 2024, the Ways and Means Committee met and House Bill 263 was heard for a fourth time. During the committee hearing, Representative Hall introduced a substitute bill with four key amendments to the original legislation, lowering the age requirement, maximum allowable income, maximum allowable home value, and required length of residency prior to being eligible for participation.

Authorizes the refundable thriving families tax credit

Sponsors: Representatives Casey Weinstein and Lauren McNally

Introduced in the House on October 3, 2023, and referred to the Ways and Means Committee on October 10, 2023. HB 290 would offer a refundable tax credit of $1,000 per year for children aged 0-5, and a credit of $500 per year for children 6-17. The legislation awaits further movement.

Establishes Adverse Childhood Experiences Study Commission (ACES)

Sponsors: Representatives Rachel Baker and Sara Carruthers

HB 352 was introduced on December 4, 2023, and referred to the Behavioral Health Committee on December 6, 2023. The legislation establishes the study commission and requires the commission recommend legislative actions to address adverse childhood experiences. The study commission would consist of 21 members, most appointed to the governor as well as one member from each party in the House and Senate.

Phase-out state income tax; repeal commercial activity tax

Sponsors: Representatives Adam Mathews and Brian Lampton

HB 386 was introduced on January 24, 2024 and referred to the Ways and Means Committee on February 6, 2024. The legislation would eliminate the state income tax on nonbusiness income over the next six years, and after 2029, would repeal the commercial activity tax. There is a companion bill in the Senate (SB 216).

Regards enforcement of Renovation, Repair, and Painting Rule

Sponsors: Representatives Rachel Baker and Andrea White

HB 388 was introduced on January 29, 2024, and referred to the Public Health Policy Committee on February 6, 2024. The legislation authorizes the Director of the Ohio Department of Health to enter into agreements with the EPA for administration/enforcement of the federal Renovation, Repair, and Painting Rule (RRP). RRP requires a certification process for firms completing projects that disturb lead-based paint in homes, childcare facilities and pre-schools built before 1978. The certification process helps ensure lead-safe work practices are followed.

Requires public schools to provide meals and related services

Sponsors: Representatives Darnell Brewer and Ismail Mohamed

HB 408 was introduced on February 12, 2024. The legislation requires school districts serve a student a meal, regardless of whether the student has the funds to pay for the meal. If passed, school districts would no longer be able to discard an already-served meal if the student is unable to provide payment for the meal, nor will districts be allowed to refuse to provide a meal or stigmatize the student in any way.

Establishes supplemental benefit for certain SNAP recipients

Sponsors: Representatives Daniel Troy and Jay Edwards

HB 428 was introduced on February 27, 2024. The legislation would provide an additional SNAP benefit for individuals 60 years of age or older and currently receiving a monthly nutrition benefit allotment of less than $50/month. If passed, HB 428 uses state funds to raise the floor to $50/month for older Ohioans receiving nutrition assistance.

Regards driver’s license suspension law; financial responsibility

Sponsors: Senators Louis Blessing and Catherine Ingram

SB 37 was introduced on January 31, 2023, and referred to the Judiciary Committee on February 8, 2023. The legislation removes the possibility of suspending an individual’s driver’s license for drug offenses (aside from first degree felonies), failure to pay child support, and truancy. SB 37 would also reduce the lookback period allowed for suspension of driver’s license due to proof of financial responsibility penalties.

Enact Ohio Higher Education Enhancement Act

Sponsor: Senator Jerry Cirino

SB 83 was passed by the Ohio Senate on May 17, 2023. It was introduced in the House on May 22, 2023, and most recently re-referred to the House Rules and Reference Committee on January 3, 2024. SB 83 would prohibit in most instances any mandatory orientation or training courses regarding diversity, equity, and inclusion (DEI). Among other things, the legislation would also require all state institutions of higher educations to create a syllabus for each course and make the syllabus publicly-available on the university website.

Revise Ohio’s Unemployment Compensation Law

Sponsors: Senators George Lang and Mark Romanchuk

SB 116 was introduced on April 26, 2023, and referred to the Insurance Committee on May 4, 2023. The legislation would raise the taxable wage base from $9,000 to $9,500 used to calculate employer contributions under Ohio’s Unemployment Compensation Law. SB 116 also eliminates dependency class caps for weekly unemployment benefits, makes the maximum weekly benefit amount up to 50 percent of the statewide average weekly wage, and reduces the maximum number of weeks an individual can receive unemployment benefits in a year from 26 weeks to 12-20 weeks.

Phase-out state income tax; repeal commercial activity tax

Sponsors: Senators George Lang and Stephen Huffman

SB 216 was introduced on January 23, 2024, and referred to the Senate Ways and Means Committee on January 24, 2024. The legislation would eliminate the state income tax on nonbusiness income over the next six years, and after 2029, would repeal the commercial activity tax. There is a companion bill in the House (HB 386).

OneOhio Recovery Foundation Regional Grants

by: Andy Jesson, AOF Policy & Communications Intern

The opioid epidemic continues to harm Ohioans and families across the state. In 2022, nearly 5,000 Ohioans died as a result of an unintentional drug overdose, with over 80 percent of deaths involving opioids. The OneOhio Recovery Foundation was created to use state funds received from settlements with pharmaceutical companies to invest in substance misuse prevention, treatment and recovery efforts, and increase access to critical resources for people who use drugs.

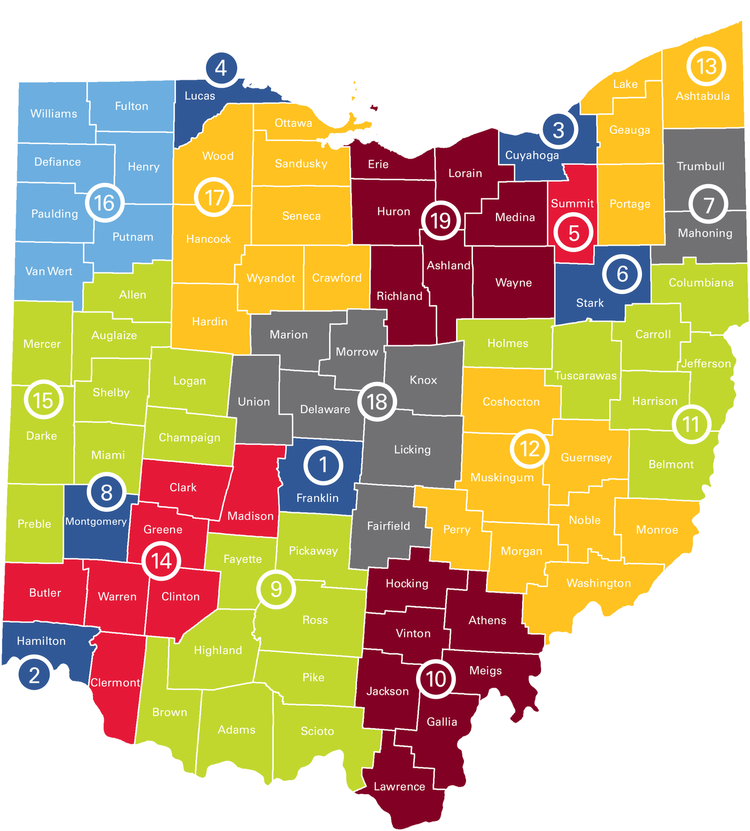

The OneOhio Recovery Foundation is a private, non-profit organization created by state and local leaders in Ohio. The Foundation is responsible for distributing 55 percent of the funds received from settlements between the state and pharmaceutical companies for their role in Ohio’s opioid epidemic. The other 45 percent of funds go directly to local governments and the state. While this year’s grant applications will result in no more than $51 million being distributed, the OneOhio Recovery Foundation is ultimately responsible for distributing about $860 million received from settlements with pharmaceutical companies.

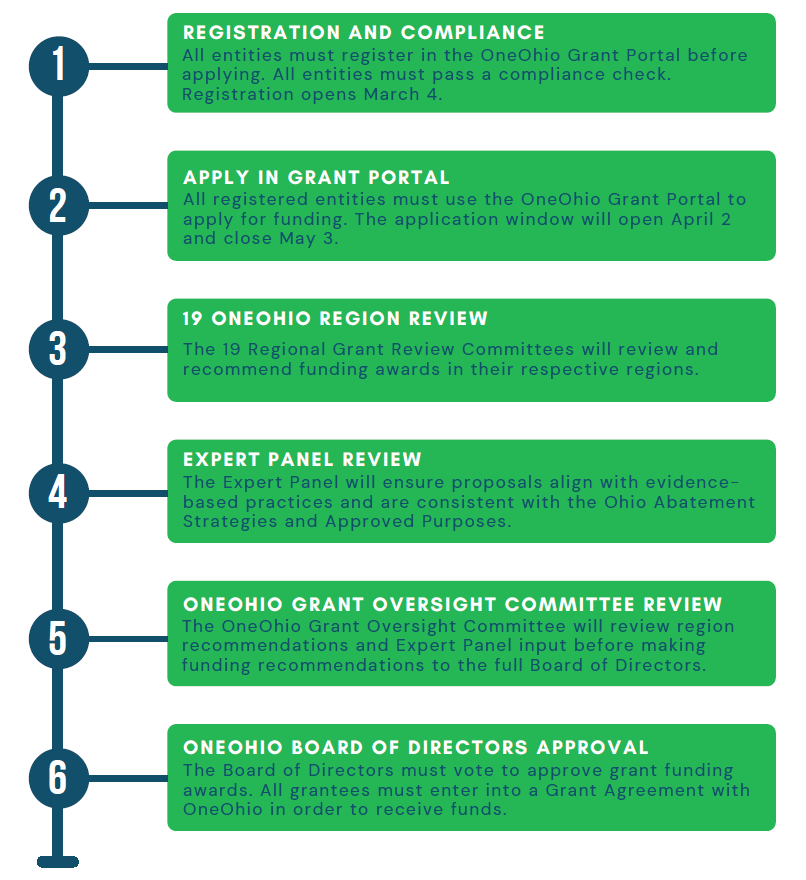

On March 4, the 2024 Regional Grant Request for Proposal (RFP) was posted and registration opened in the OneOhio Grant Portal. Applications for the 2024 Regional Grant open on April 2, and must be submitted by May 3. In a statement regarding the release of their 2024 Regional Grant Cycle RFP, Alisha Nelson, Executive Director of OneOhio, stated, “After months of carefully developing this first-ever program, we look forward to seeing the innovative ideas presented to combat the epidemic in every corner of the state”.

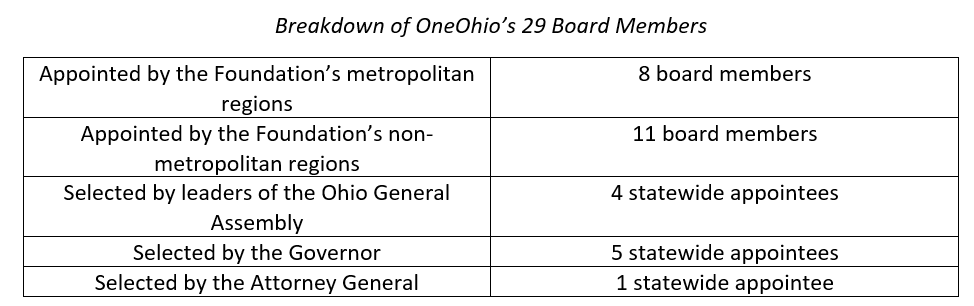

OneOhio is led by Director Nelson and governed by a board of 29 experts and leaders representing 19 regions across the state.

Map of the 19 OneOhio Regions

Within the newly-released RFP, OneOhio notes, “Successful grants will promote the health and safety of Ohioans by implementing evidence-based, forward-looking strategies. Grant terms can be 12 months, 24 months or up to 36 months in total. Funding proposals cannot be used to supplant existing programs or services. Successful proposals will support new or expanded programs or enhancements to existing programs”.

The 19 regions are set to receive a predetermined about of funding for grant opportunities, which will then be allocated within the region. Each region has a Regional Grant Review Committee tasked with reviewing grant applications and making recommendations on which organizations receive funding awards. Applications are then reviewed by the OneOhio Expert Panel, Grant Oversight Committee, and Board of Directors to ensure compliance with all regulations. Following approval, organizations will enter into a Grant Agreement with OneOhio and begin receiving funds.

OneOhio Grant Application and Approval Process

Eligible recipients for grant funding from OneOhio must be

Tax-exempt organizations under Section 501 (c)(3) or other relevant sections of the Internal Revenue Service Code, or

Private, for-profit organizations offering services that meet the charitable purpose of the Foundation, or

Any form of state or local government

The 2024 Regional Grant Cycle represents the first of a series of funding opportunities for organizations across the state. The OneOhio Recovery Foundation will continue to disperse funds over the next 15-20 years as money from settlements continues to reach the state.

The Insulin Reduction Act (House Bill 384)

by: Andy Jesson, AOF Policy & Communications Intern

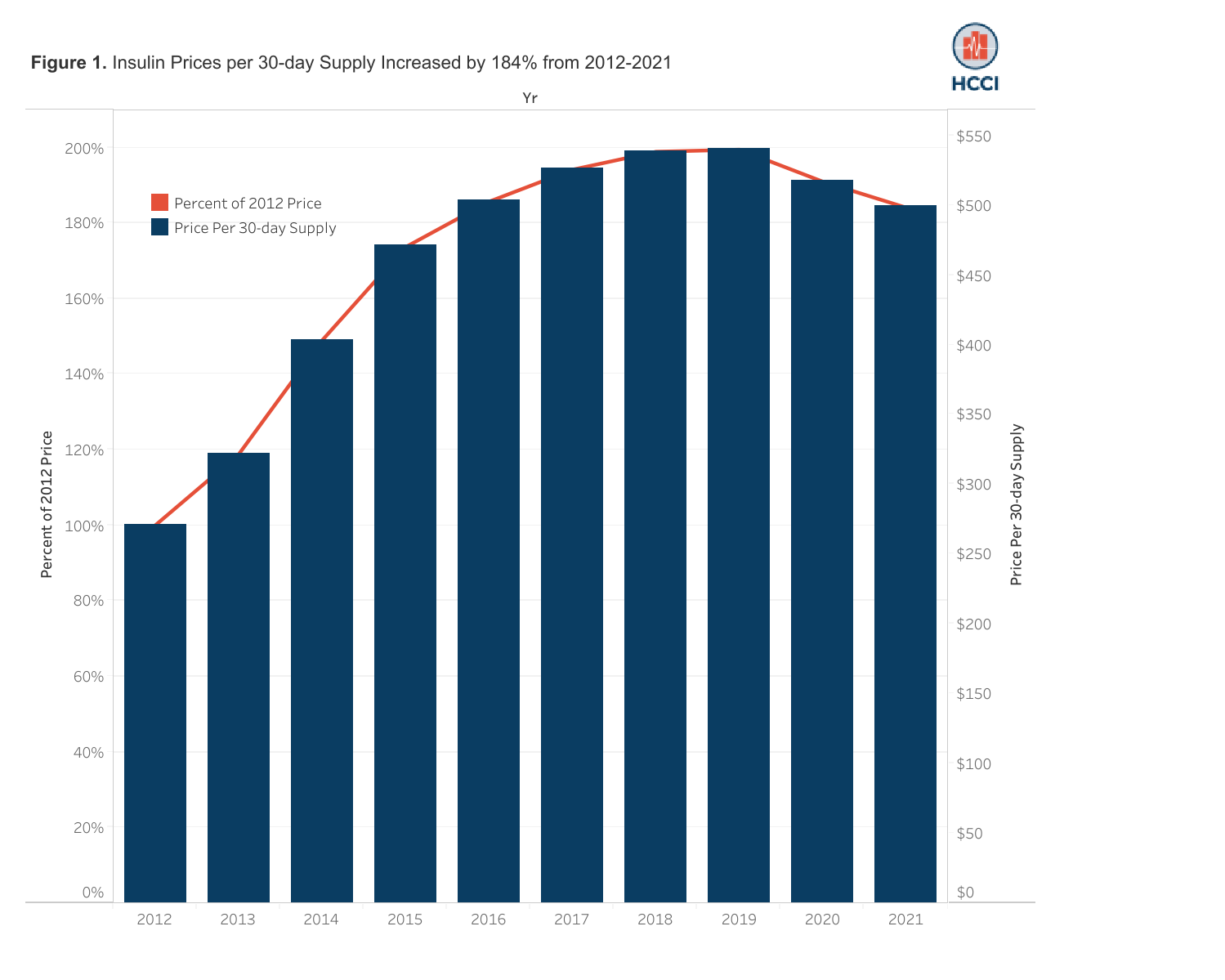

Over one million Ohioans have diagnosed diabetes and rely upon prescription insulin for their everyday well-being. For people with diabetes, insulin is vital, and often costly. Nationally, the price of a 30-day supply of insulin increased by 184 percent between 2012 and 2021. Prices have declined slightly in recent years but still remain significant for individuals already paying more on healthcare. On average, people with diabetes spend 2.3 times more on medical expenses compared to those without diabetes.

High insulin costs can have devastating health consequences, with some individuals forced to ration their supply. In one study of Americans with diabetes under the age of 65, nearly a third had rationed their insulin supply at least one time over the preceding year as a means of saving money. Individuals rationing their supply of insulin increase the risk of multiple health complications, including diabetes-related ketoacidosis (DKA), a serious, life-threatening complication that occurs when an individual’s body is not producing enough insulin. Diabetes is the eighth-leading cause of death in the state of Ohio, further emphasizing the need for proper treatment of the condition to mitigate the risk of life-threatening consequences.

Representatives Munira Abdullahi and Thomas Hall recently introduced House Bill 384, also known as the Insulin Reduction Act, which would cap out-of-pocket costs for insulin and diabetes-related devices. The proposed legislation caps insulin costs for Ohioans at $35 a month, and caps the cost of diabetes devices at $100 monthly.

Part of the 2022 Inflation Reduction Act passed at the federal level included a cap on the monthly cost of insulin for individuals enrolled in Medicare at $35 per month. This change represented a significant cost reduction for individuals enrolled in Medicare, but the Inflation Reduction Act did not reduce costs for individuals with diabetes who utilize private health insurance. House Bill 384 seeks to change this reality for Ohioans with diabetes, including everyone within the insulin price limit.

During a February 6th press conference discussing the Insulin Reduction Act, Representative Abdullahi noted “Comparatively, on the international scale, the cost of insulin in America is nearly 10 times the world average” while Representative Hall pointed out the origin of the introduced legislation stemmed from an encounter wherein the two lawmakers discovered the other was also a type-1 diabetic. Both Representatives Abdullahi and Hall touted the Insulin Reduction Act for the meaningful impact it will have on Ohioans with diabetes.

According to the American Diabetes Association, passage of the Insulin Reduction Act would make Ohio the 26th state in the country to cap insulin copays for individuals with diabetes. The below map indicates which states already have a cap on insulin co-payments. States with an existing cap are marked red. A complete list of state policies regarding insulin caps can be found here.

State Insulin Copay Caps

House Bill 384 has garnered bipartisan support, with over two dozen cosponsors. The legislation was assigned to the House Insurance Committee on February 6th, where it awaits further movement.

The Suicide Prevention Plan for Ohio

by: Andy Jesson, AOF Policy & Communications Intern

HPIO Snapshot of Mental Health Challenges Among Ohio High School Students

Approximately five Ohioans die by suicide every day. This statistic headlined the February 9th release of the Health Policy Institute of Ohio (HPIO) data snapshot detailing key statistics surrounding the prevalence of suicide and mental illness in the state of Ohio. Suicide is the fifth leading cause of death among working-age Ohioans, and HPIO’s data snapshot shows mental health challenges are increasingly common among school-aged Ohioans.

In response to the concerning rise in prevalence of mental illness and suicide, Governor DeWine announced a two-year suicide prevention plan earlier this year aimed to increase awareness, data collection, and expand access to health care and support services for Ohioans impacted by suicide. The Suicide Prevention Plan for Ohio (2024-2026) follows the first Ohio Suicide Prevention Plan (2020-2022). The first initiative presented the vision and guidance used by thousands of state and community groups to engage in suicide prevention efforts. Ohio now seeks to further the roadmap to mitigate the prevalence of suicide in the state. This newest edition of a suicide prevention plan is outlined by four strategic priorities and guided by numerous goals to ensure success in advancing the scope of suicide prevention in Ohio.

Strategic Priority 1: Community Systems

The first strategic priority within The Suicide Prevention Plan for Ohio centers on building the needed capacity and infrastructure within local/state organizations and communities for effective prevention initiatives. Building this capacity requires strengthening public knowledge of suicide prevention and risk behaviors and reducing stigma surrounding topics of mental health and suicide. Strategic priority 1 also involves expansion/sustaining of suicide prevention coalition capacity, as well as increased efforts to have safe storage of lethal means (firearms, medications, etc.).

Strategic Priority 2: Prevention & Early Intervention

The Suicide Prevention Plan for Ohio strategic priority 2 supports the capacity of organizations to implement prevention initiatives and looks to improve coordination across multiple sectors and settings. The two main goals within this strategic priority are increasing the integration of suicide prevention into the workplace and educational systems, and integrating suicide prevention best practices for high-risk populations. Within the overall framework of this suicide prevention plan is a focus on groups disproportionately impacted by suicide, including males, young adults, veterans, people living in rural and Appalachian regions, LGBTQ+ Ohioans, and Ohioans with disabilities.

Strategic Priority 3: Quality Treatment & Postvention

The third strategic priority emphasizes improved access to high-quality suicide care and support services, in alignment with the Zero Suicide framework. The Zero Suicide framework is a model for improving suicide care through seven elements of safe and effective suicide care.

Goals of Strategic Priority 3

1. Increase screening and risk assessment

2. Improve care transitions and coordination

3. Improve access to effective treatment and care

4. Improve access to postvention services

5. Align healthcare payment and payor policies with evidence-informed practices

6. Strengthen Ohio’s Suicide Mortality Review Board process

Strategic Priority 4: Data & Evaluation

The fourth and final strategic priority of The Suicide Prevention Plan for Ohio will build data/evaluation capacity among both private and public partners at the local and state levels. This priority includes improvement of data collection and reporting, and increasing data collection related to risk and protective factors. Data collection includes efforts to monitor existing suicide prevention programs and services, as well as exploration of new approaches to suicide prevention.

Suicide and mental health challenges continue to plague many Ohioans on a daily basis. The first Ohio Suicide Prevention Plan yielded promising results in increasing engagement with Ohioans and improving suicide prevention initiatives across the state. The Suicide Prevention Plan for Ohio seeks to expand upon the efforts of its preceding initiative and increase prevention efforts, improve treatment quality, and monitor the success of suicide prevention programs, all in an effort to minimize the prevalence of suicide and mental health challenges among Ohioans.

Talking Taxes: House Bills 263 and 344

by: Andy Jesson, AOF Policy & Communications Intern

Over the past few months, the Ohio House of Representatives has discussed passage of multiple bills regarding property taxes paid by Ohioans. House Bill 263 and House Bill 344 are two pieces of legislation seeking to change how much Ohioans pay in property taxes in certain situations, with House Bill 263 targeting older adults and House Bill 344 the elimination of replacement levies.

State Representatives Hall and Isaacsohn introduced House Bill 263 last September. If passed, the legislation would freeze property tax amounts for older Ohioans who own homes, ensuring individuals often on a fixed income do not pay a larger property tax bill year-over-year. House Bill 263 is currently in the Ways and Means committee, with 25 cosponsors and widespread bipartisan support. On February 6, 2024, the Ways and Means committee met and House Bill 263 was heard for a fourth time. During the committee hearing, Representative Hall introduced a substitute bill with four key amendments to the original legislation.

Amendments to House Bill 263

Lowers the maximum allowable income from $70,000 to $50,000 per year

Lowers the minimum age requirement from 70 to 65

Lowers the maximum allowable home value from $1 million to $500,000

Lowers the required length of residency from 10 years to two years

Both Representatives Hall and Isaacsohn noted that the changes made were in response to feedback received from Ohioans across the state, and the changes in requirements, particularly lowering the age requirement by five years, will greatly increase the number of older Ohioans able to participate in the property tax freeze, as will reducing the number of years an individual needs to live in their home prior to becoming eligible for the freeze. Following a period of questioning among lawmakers, the substitute bill was accepted by the Ways and Means committee without objection.

In a different initiative, State Representatives Mathews and Hall introduced House Bill 344, legislation that would eliminate replacement property tax levies in Ohio. Replacement levies differ from renewal levies, as the former allows the jurisdiction to benefit from increased property values between the time the levy was originally passed and when it is replaced. In simpler terms, the use of replacement levies results in homeowners paying a larger bill if their property value has increased since the levy was first passed. Replacement levies are not tax rate increases but are intended to account for growth in the value of properties over time. They are used throughout the state to fund townships, schools, libraries, and more.

Proponents of the legislation view its passage as key to eliminating confusion among voters regarding a levy’s effect on their tax bill, while those against House Bill 344 have expressed concern over taking away one of the few methods jurisdictions have to pay for vital community resources. Currently, House Bill 344 has been introduced and referred to the House Ways and Means committee, where four hearings have now been held in regards to the legislation. During the February 6 House Ways and Means committee hearing, Representative Hall introduced a short amendment to House Bill 344 that was passed without objection, and the public was given the opportunity to testify on the legislation. The elimination of replacement levies represents one of multiple different controversial initiatives by legislators targeting crucial sources of revenue for the state and local communities. In recent weeks, legislators in the House and Senate introduced legislation that would eliminate state income tax for Ohioans over the course of the next decade.

Breakdown of Revenue Sources for State & Local Governments

Passage of House Bill 344 or legislation eliminating the state income tax both present challenges to the future ability of state and local governments in Ohio to fund public services. During the House Ways and Means committee hearing on February 6, State Representative Lear expressed concerns levied by local leaders about the implications of House Bill 344 on not being able to keep up with expanded service needs for rapidly-growing communities in Ohio. As shown in the chart above, property taxes represent significant funding for state and local governments, especially at the local level. For the vast majority of local communities across the country, property taxes represent the single largest source of revenue. Increasingly, the uncertain future of tax revenue in Ohio has been used as a potential barrier to passing legislation. During earlier discussion surrounding House Bill 263, State Representative Troy noted the likely cost of implementation of House Bill 263 as a concern in light of efforts to eliminate the state income tax.

Though neither House Bill 263 nor House Bill 344 have been brought before the entire General Assembly as of yet, both are important to watch for the future of property taxation in Ohio, both from the perspective of the taxpayer and local governments. More broadly, the next few months hold the potential to be critical to understanding the long-term outlook for the funding of health and human services across the state.

OhioRISE: An Update

by: Andy Jesson, AOF Policy & Communications Intern

OhioRISE (Resilience through Integrated Systems and Excellence) is a state program created as part of Ohio Medicaid’s effort to launch a new era of Medicaid for Ohioans, focused on specialized care for youth with complex needs. OhioRISE was created in recognition of the need for specialized services targeted at Ohio children and youth. OhioRISE was designed for multi-system youth, that is, kids and families involved with multiple systems in pursuit of receiving care, with an eventual goal of providing care coordination and oversight to all aspects of the child’s care.

The OhioRISE initiative is working towards offering six unique programs for youth with complex behavioral health needs. New services will include intensive and moderate care coordination (ICC/MCC), intensive home-based treatment (IHBT), psychiatric residential treatment facilities (PRTF), mobile response and stabilization services (MRSS), behavioral health respite, and primary flex funds. These new services will be provided in addition to existing community behavioral health services and other outpatient and inpatient hospital behavioral health services. More information about each service provided through OhioRISE can be found here.

This past November, Ohio’s first PRTF opened in Grove City, equipped to serve 12 youth at any given time. Over the next three years, OhioRISE anticipates the opening of 11 additional PRTFs located throughout the state.

Eligibility Requirements for Participation in OhioRISE

Individual must be eligible for Ohio Medicaid (either managed care or fee-for-service)

Must be age 0-20

Individual requires significant behavioral health treatment needs, measured using the Ohio Child and Adolescent Needs and Strengths (CANS) assessment

Children may also be eligible for participation in OhioRISE if an urgent health condition arises.

As of December 2023, more than 28,000 Ohio children and youth are enrolled in OhioRISE. OhioRISE releases a monthly newsletter containing important information regarding future projects and current work. The most recent OhioRISE Together newsletter can be found here. For direct help/information, contact your local care management entity (CME).

AOF's 2024 Eligibility Resources Available Now!

AOF is excited to release updated public benefits eligibility resources for advocates:

2024 Public Benefits Eligibility Guide: Dive into eligibility for Ohio Works First, SNAP, Publicly Funded Child Care, and the Special Supplemental Nutrition Program for Women, Infants and Children.

2024 Medicaid Eligibility Guide: Break down five eligibility pathways into Ohio Medicaid coverage.

Ohio's New SOAR Study

by: Andy Jesson, AOF Policy & Communications Intern

Mental illness, substance use disorder, suicide and accidental overdoses all remain serious barriers to the overall well-being of Ohioans in 2024. CDC data ranks Ohio 5th in the nation in aggregate drug overdose deaths and 7th in death rate. Additional research by the Kaiser Family Foundation shows the prevalence of depression/anxiety and suicide rates in Ohio are slightly higher than the national average, and have risen over recent years. Overall, an average of 19 Ohioans each day die from an accidental overdose or suicide. Governor DeWine has made tackling the issues of mental health and substance use key aspects of his administration’s objectives, and a monumental announcement last week demonstrates the state’s long-term commitment to bettering the behavioral health landscape throughout the state.

On January 19th, Governor DeWine and The Ohio State University announced the launch of a new study researching risk and resiliency factors behind mental health and substance use disorder among Ohioans. The SOAR (State of Ohio Adversity and Resilience) study begins with $20 million in funding from the Ohio Department of Mental Health and Addiction Services and is being touted as the first study in the nation that will examine a statewide, multigenerational population in pursuit of improved outcomes regarding mental health and substance use.

The SOAR Study team is being led by Dr. K. Luan Phan, the Chair of the Department of Psychiatry and Behavioral Health at Ohio State. When asked about the study, Dr. Phan said “SOAR is our effort to do for addiction, mental illness and mental health, what the Framingham Heart Study researchers did for heart disease and heart health.” The Framingham Heart Study was first launched in the late 1940s and is credited with uncovering many major heart disease risk factors.

The SOAR study is set to begin with two main projects completed simultaneously, the SOAR Wellness Discovery Survey and the SOAR Brain Health Study. The SOAR Wellness Discovery Survey is set to engage with as many as 15,000 Ohioans across the state to understand the breadth of mental health and substance use. Through the survey, researchers hope to identify risk factors as well as strengths and skills individuals use to overcome adversity. The SOAR Brain Health Study centers on depth, and will examine the biological, psychological, and social factors contributing to mental illness, substance use disorder, drug overdose, and suicide among Ohioans.

Due to its complex and encompassing nature, the SOAR study is expected to last at least a decade, if not longer. Though it is being led by researchers at The Ohio State University, universities across the state are working in collaboration with OSU to achieve the most comprehensive results possible. The end goal of SOAR is the creation of a roadmap to improve mental health and save lives. The official SOAR website can be found here.

Map of Universities Working in Collaboration on SOAR

Who We Are: AOF 101

by: Andy Jesson, AOF Policy & Communications Intern

Advocates for Ohio’s Future (AOF) is a nonpartisan, nonprofit coalition of health and human services advocacy, provider, and research organizations. Our main goal is to bring health and human services organizations together to be in coalition, sharing knowledge and advocating for progress in policy. In pursuit of our main goal, AOF maintains the following policy platform; healthy children and families, quality communities, and pathways to prosperity for all. AOF’s work focuses on policy change at the state-level to support and empower Ohioans and their families.

AOF began in 2003 as the Emergency Campaign to Protect Ohio’s Future, a coalition of health and human service organizations set on protecting Ohio’s most vulnerable citizens through a state budget that invests in vital services. Founded by legendary advocates John Corlett, Marcia Egbert, and Gayle Channing Tenenbaum, the Campaign to Protect Ohio’s Future was renamed Advocate’s for Ohio’s Future in 2010 as a reflection of our long-term commitment to maintaining vital public services throughout the state of Ohio.

Currently, 30 member organizations serve on the AOF Steering Committee, which meets once every month. The Steering Committee is the driving force for what AOF seeks to accomplish in our commitment to bettering the health and human services landscape in Ohio. The priorities of our Steering Committee members are critical to determining the legislation wherein AOF provides public testimony. Our past submissions of public testimony can be found here.

In addition to our Steering Committee, Advocates for Ohio’s Future hosts monthly meetings with our Public Policy Committee, nutrition workgroup, and our brand-new benefits cliff workgroup. Each meeting includes advocates from across the state and is an opportunity to raise awareness regarding current events and set an agenda for advocacy in each specific policy area.

AOF is grateful for the work and leadership of our Co-Chairs, Susan Jagers (Ohio Poverty Law Center) and Nick Bates (Hunger Network in Ohio), as well as our Executive Committee: Teresa Lampl (The Ohio Council of Behavioral Health & Family Services Providers), Darold Johnson (Ohio Federation of Teachers), Joree Novotny (Ohio Association of Foodbanks), Gina Wilt (Coalition on Homelessness and Housing in Ohio), and Tara Britton (The Center for Community Solutions).

AOF is looking forward to a busy year ahead advocating for improved health and human services throughout the state. As the March primary elections quickly approach, AOF will work on voter education to ensure Ohioans are aware of registration deadlines, ID requirements, and more.

As we approach the 2025 state budget, AOF is making preparations to host the 2024 Budget Training Academy this summer and fall. The Budget Training Academy provides an opportunity to share insight with advocates on Ohio’s biennial budgeting process and how to ensure health and human services remain at the forefront of the budget. AOF also hosted a series of budget webinars throughout the last budgeting process, and are looking forward to doing so again next year.

In addition to our election information and budget awareness objectives, providing solutions to the benefits cliff is an area central to our advocacy plans in the upcoming year. AOF began meeting with a group of advocates last year regarding the benefits cliff. Our goal in 2024 is to advocate for legislative and administrative solutions to the benefit cliff, with a focus on the 2025 state budget. More information on this work will be announced soon.

Each week, AOF releases a newsletter containing updates on the world of Ohio advocacy, links to critical resources and AOF blog posts, and information about upcoming member events. If you would like to be added to our email list, please click here. You can also follow us @Advocates4OH on Facebook and Twitter/X.